College Planning Center

College Planning Center

We're here to help.

Navigating your financial aid options can be confusing. We've collected all our best tips about how to make the most of free money, reduce your loan amount, and succeed in college. And if you can't find what you need here, just get in touch with us!

Most Recent

All ResourcesToolkit

Find Your Student Aid Index »

The Student Aid Index will replace the EFC (Expected Family Contribution) on the FAFSA beginning in 2024-2025. Use this calculator to figure out what your Student Aid Index will be. This number will determine how much need-based federal student aid you'll be eligible for!

Search For Scholarships »

Our scholarships page will guide you through all the different options available to you, then you can use our scholarships search tool to find grants and scholarships from state and national organizations. Just enter your demographic info and we’ll filter the list for you!

#NoEffort

$5K Scholarship Giveaway

Two lucky students will win $2,500 for college. Entering takes less than a minute, and you can come back each month for another shot.

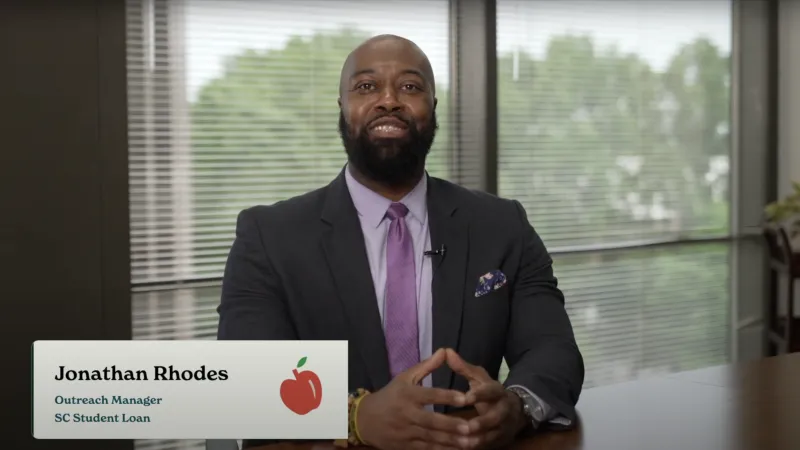

Talk to an Expert.

Access to our trained advisers is just one perk of using South Carolina Student Loan. They’ll help you maximize your scholarships and grants (ie: free money!) and then help you make up the difference with a smaller loan amount that you’ll be able to repay faster.

Call »

Talk to a human

(800) 347-2752

Chat

Click "Live Chat" for quick replies M-F, 8-5

Email »

Easy connection to our advisers 24/7